Washington County Indiana Incentives

For Urban Enterprise Association membership forms or tax abatement forms or information please contact

Salem Urban Enterprise Zone

The three tax credits that were available to businesses this past year were the Employment Expense Credit, Enterprise Zone Investment Deduction and Loan Interest Credit. The Employment Expense Credit was available to all zone businesses that had zone employees. The Loan Interest Credit was available to those businesses within the zone, lending money to zone businesses. The Enterprise Zone Investment Credit is available to individuals purchasing an ownership interest in a business in the zone. I certainly hope you took advantage of these credits. Many zone resident employees were allowed a deduction from their personal Indiana state tax return for last year. Those who did not take advantage of these credits are encouraged to discuss the potential benefits with your tax advisor and possibly file an amended return.

The three tax credits that were available to businesses this past year were the Employment Expense Credit, Enterprise Zone Investment Deduction and Loan Interest Credit. The Employment Expense Credit was available to all zone businesses that had zone employees. The Loan Interest Credit was available to those businesses within the zone, lending money to zone businesses. The Enterprise Zone Investment Credit is available to individuals purchasing an ownership interest in a business in the zone. I certainly hope you took advantage of these credits. Many zone resident employees were allowed a deduction from their personal Indiana state tax return for last year. Those who did not take advantage of these credits are encouraged to discuss the potential benefits with your tax advisor and possibly file an amended return.

The Salem Urban Enterprise Zone was established effective January 1, 2003 and is established for a 10 year period ending December 31, 2012 unless an extensions are granted. An extension was granted again in December 2023 to extend the term of the Salem Urban Enterprise Zone to December 2028.

The Salem Urban Enterprise Zone was established effective January 1, 2003 and is established for a 10 year period ending December 31, 2012 unless an extensions are granted. An extension was granted again in December 2023 to extend the term of the Salem Urban Enterprise Zone to December 2028.

For those businesses who took advantage of available tax credits, a form EZB-R is required to be completed and submitted by June 1 of each year. Part II of the form details the tax savings that your business received. On line 17 is the Total Tax Savings (does not include savings that your employees received with form IT-40QEC).

If your business tax savings totaled more than $1,000, you will need to remit 1% of your total tax savings (enter amount in line 18) to Indiana Economic Development Corporation. Even if your tax savings was not more than $1,000, this form MUST STILL BE FILED. The original EZB-R form and applicable Registration Fee (if any) are to be mailed to:

Indiana Economic Development Corporation

Indiana Enterprise Zone Program

One North Capitol, Suite 700

Indianapolis, IN 46204-2288

On line 19, enter the amount of Financial Compliance to the Salem Urban Enterprise Zone Association. This is calculated at 35% times the Total Tax Savings on line 17. The taxpayer must also pay a percentage (1%) Registration fee to the State Enterprise Zone Board if the zone benefits claimed exceed $1,000 (example: business saves $5,000; SUEZ participation fee is $1,750; state registration fee is $50).

This participation fee and a copy of the form EZB-R are to be mailed no later than June 1 to:

This participation fee and a copy of the form EZB-R are to be mailed no later than June 1 to:

Salem Urban Enterprise Zone Association

C/O First Savings Bank

1336 South Jackson Street

Salem, IN 47167

A business must remain open and operating as a zone business for twelve (12) months of the assessment year for which the incentive is claimed.

The other 64% of your tax savings are required to have been reinvested in YOUR company either through increased zone wages or increased property or plant equipment (which most of you probably did anyway whether you had a tax credit or not). Examples include additional capital expenditures for buildings, machinery or equipment; additional inventory investment; or increase in total compensation for all zone resident employees. This compliance is shown in part III lines 20-21. Be sure to keep a copy for your records.

Below are some examples to help you understand the fee per tax savings:

Example 1: Tax savings of $500

| Total Tax Savings (from Line 17) | $500.00 | |

| Registration fee to State Enterprise Zone Board (Line 18) | 0.00 | Must still file original EZB-R |

| Participation fee to Salem Urban Enterprise Zone Association | 175.00 | Send check with copy of EZB-R |

Example 2: Tax savings of $2,000

| Total Tax Savings (from Line 17) | $2000.00 | |

| Registration fee to State Enterprise Zone Board (Line 18) | 20.00 | Send check with original EZB-R |

| Participation fee to Salem Urban Enterprise Zone Association | 700.00 | Send check with copy of for EZB-R |

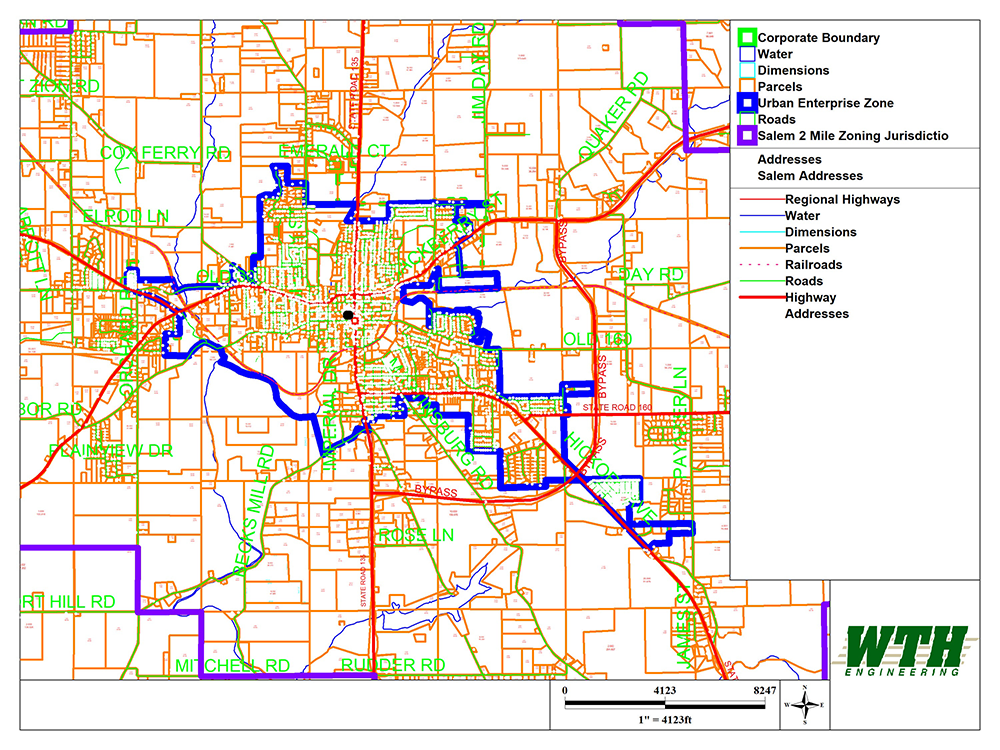

Urban Enterprise Zone Map

For Urban Enterprise Association membership forms or tax abatement forms or information please contact

For Urban Enterprise Association membership forms or tax abatement forms or information please contact This email address is being protected from spambots. You need JavaScript enabled to view it. or call 812.620.5809.

For a list of businesses within the Salem Urban Enterprise Zone click here.

Call the number above if you believe your business is within the zone, but not on the list.

Tax Abatement

Washington County Government uses tax abatement as a tool for expanding our local economy. Tax abatement encourages new investment in our community and helps maintain and increase employment in the community. Tax abatement is also a tool used to encourage redevelopment of deteriorated areas, and/or stimulate investment in specific areas of a community. Tax abatement is one of the primary incentives available to local government to promote economic development.

Washington County Government uses tax abatement as a tool for expanding our local economy. Tax abatement encourages new investment in our community and helps maintain and increase employment in the community. Tax abatement is also a tool used to encourage redevelopment of deteriorated areas, and/or stimulate investment in specific areas of a community. Tax abatement is one of the primary incentives available to local government to promote economic development.

Who is eligible for tax abatement?

Who is eligible for tax abatement?

Property owners in Economic Revitalization Areas (ERA) are eligible for tax abatements. To qualify, owners must make improvements to real property, install new manufacturing equipment, logistical equipment, or equipment used in research and development activities devoted directly and exclusively to experimental or laboratory research and development. Tenants in leased facilities can benefit from tax abatement on real property too, if the property owner applies for the abatement and all other requirements are met. Also, tenants can benefit from abatements on manufacturing equipment, logistical equipment, information technology equipment, information technology equipment and/or research and development equipment.

How does tax abatement work?

Property taxes are phased in based on the increased assessed value that results from a new investment. Due to tax abatement, property taxes cannot be lower than the prior year's taxes. The phase-in period is determined by the local governmental body (designating body) within the framework of the schedules listed in the Indiana State Statute (IC 6-1.1-12.1).

- New real estate investment options can have abatement terms from one to a maximum of ten years.

- New manufacturing equipment, logistical equipment, informational technology equipment and/or research and development equipment options can have abatement terms from one to a maximum of ten years.